MiKaDiv

Prepare for MiKaDiv reporting procedure

With the German Act to Modernise the Relief from Withholding Tax and the Certification of Capital Gains Tax (AbzStEntModG) a new reporting process for withholding tax on dividends comes into force

MiKaDiv

Financial institutions must comply with new reporting requirements

Starting from January 1, 2025, German paying agents will be obligated to report capital gains on dividends through a digital process to the German tax authority. This will result in increased reporting responsibilities for custodian banks and foreign financial institutions. Tax reporting via MiKaDiv interface will be mandatory for reclaiming withholding tax from 2025 onwards.

SCOPE

Affected banking entities

German custodian banks and domestic paying agents

A digital report must be issued, and an order number will be generated. Tax certificates will additionally be issued for investors with tax residence in Germany.

Foreign financial

institutions

All reporting information must be disclosed to the German paying agent. Serial numbers and digital tax certificates only for German beneficial owners will be received.

Reporting of extensive data set required

Mandatory information to be reported

Types of essential content data

Customer data

Information about beneficial owner(s) and custody account number. Also information on trustee and usufruct

Securities information

Capital income and number of securities

Holdings and TRansactions

Information about number of securities at payment date and acquisitions and disposals 1 year before and 45 days after dividend payment. Settlement information needs to be provided.

Complete custody chain

Information about each financial institution in the payment chain, with LEI and holdings on each custody account

Depository receipts

ISIN of deposited securities and subscription ratio

Types of reports

Domestic taxpayers

Digital reporting of additional information and tax certificates with additional information

Non-domestic taxpayers

Digital reporting instead of tax certificate

Notification of unissued tax certificate or not executed reports

For Omnibus accounts:

Exemption report

Report indicating either no tax deduction or an incomplete tax deduction

Aggregated reports

Aggregated by securities and custodian accounts

Reporting process

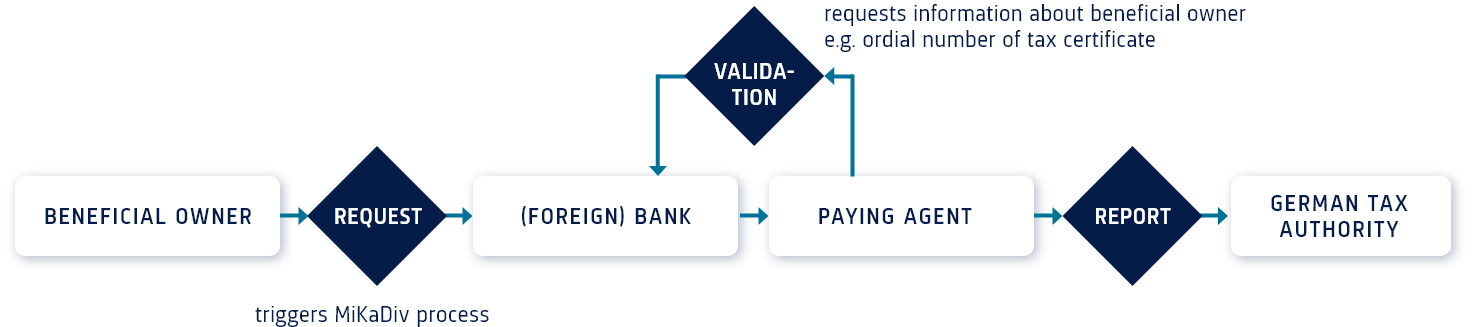

MiKaDiv process flow

MiKaDiv serves as a replacement for the existing tax certificate process. The process follows the custody chain. German paying agents are directly responsible for implementing the new procedure. In case of omnibus accounts, foreign financial institutions are required to provide relevant reporting data to the German paying agent. Impacted entities must provide a format and process by which they ensure to receive the necessary information for reporting from foreign banks.

Technical requirements

Technical report format

XML Data Structure (FSAK-FM)

SFTP Transmission of Files (ELMA)

Authentication via PKI Enterprise Certificate

Shaping the future of digital banking

We are your implementation partner for MiKaDiv

With the entry into force of AbzStEntModG, the RAQUEST experts have been engaged in the elaboration of requirements and specifications of the new reporting procedure. We established expert groups with our clients and actively participated in specialised user groups with the German tax authority and banking associations. This has facilitated a constant exchange of information with the implementing authority and other involved parties, gaining direct access in shaping the framework and process.

Expertise and CUSTOMER FOCUSED

With over 15 years of expertise in withholding tax, RAQUEST is the market-leading software solution for withholding tax processing in Europe. Our success is rooted in the synergy of in-depth knowledge and a collaborative approach with our clients, developing products for an interconnected financial industry.

proactive approach

Staying abreast of regulatory changes in withholding tax, we actively engage with clients in setting up expert groups and participating in user groups with all legal and operational entities involved. This proactive approach positions us at the forefront of developing requirements and specifications, providing access to shaping framework conditions and procedures.

sparring partner AND EARLY ADOPTER

Serving as a nexus for politics, tax authorities, associations, and the financial industry, we excel in guiding the technical and procedural implementation of digitization steps. RAQUEST's extensive network with decision-makers in politics, the finance industry and our esteemed advisory board enable us to have a keen eye for changes.

Tech and passion

Software is our DNA. The RAQUEST product team is passionate and experienced in designing, developing, and maintaining sophisticated software solutions. With focus on efficient, future-proof, accessible, and flexible web technologies.

DISCOVER RAQUEST

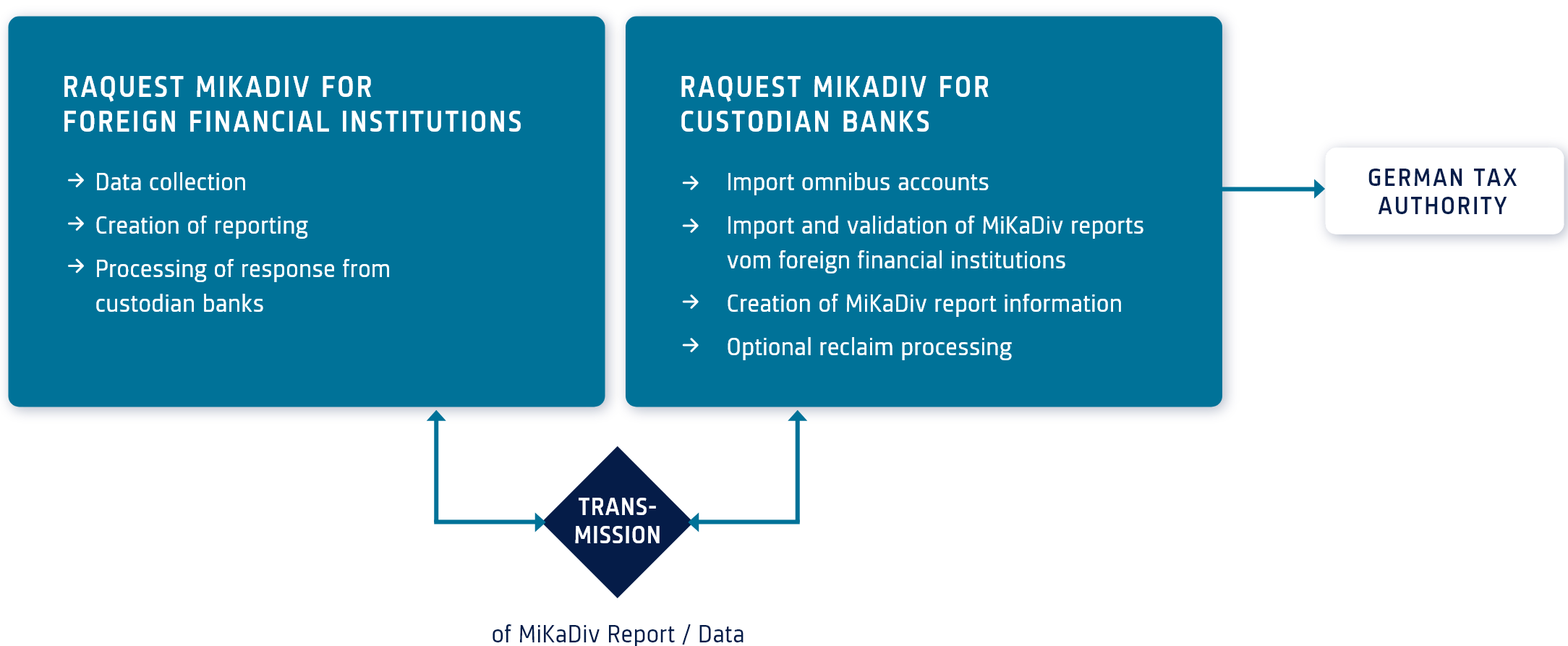

Tailored MiKaDiv solutions

Our MiKaDiv solution set offers suitable options for foreign banks and domestic paying agents to comply with the MiKaDiv procedure. The solutions are modular, customisable and can be tailored to every requirement.

Get STARTED

Essential steps for financial institutions to prepare for MiKaDiv

Build up expertise

Analyse Status quo

Identify internal Processes and systems

Request process requirements and data specifications

Implement changes promptly

MiKaDiv Webcast

Watch our webcast for more technical information and deep-dive insights

FAQs

Based on our experience, no. An Excel-based exchange of data could only be used for individual reports. Overall, however, an exchange with Excel only has technical limitations and we recommend a sophisticated structured data format like XML.

German financial institutions and paying agents are legally obliged to provide MiKaDiv reporting. All (foreign) financial institutions should strongly consider implementing the MiKaDiv requirements in order to be able to provide their clients with a tax reclaim service as part of their competitive service portfolio.

STTI Gateway

Mastering digital claiming procedures

STTI facilitates secure data transfer regardless of the required procedure. The interface supports the electronic submission of applications or seamlessly transfers data to the tax authorities’ web form. Avoid tying up valuable resources by developing a system in-house – opt for a market-proven solution instead.